After Years of Financial Stress, Baker & Taylor Collapses

In a sudden end to what many saw as a slow-moving inevitability, the nearly 200 year-old company is ceasing operations after a foreclosure sale to ReaderLink fell through.

In a move described by several librarians as shocking but not surprising, leading library vendor Baker & Taylor is ceasing operations, just days after a proposed acquisition of the embattled library supplier fell through.

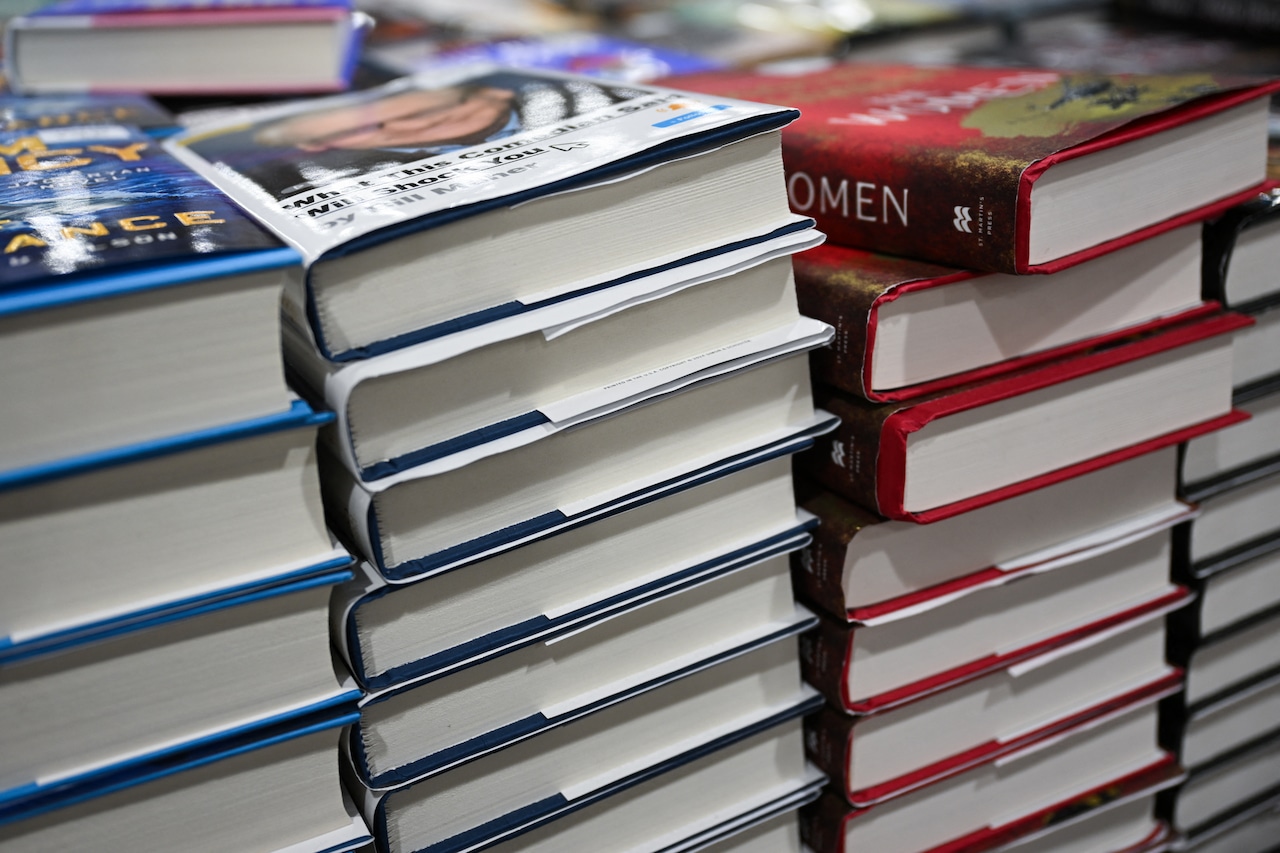

According to reports in several local outlets and a vigorous discussion on Reddit, hundreds of workers have already been let go, with more to come by the end of the year as the nearly 200 year-old company shutters.

In an article for American Libraries, Marshall Breeding, the well-known expert on the library market and editor of the website Library Technology Guides, said the loss of Baker & Taylor will be "extraordinarily disruptive," noting that not only have libraries lost a major materials vendor, but many publishers will also have to "scramble to establish arrangements with other distributors" and "risk losses of inventory held in B&T warehouses."

The news of Baker & Taylor's collapse represents a sudden end to what many saw as a slow-moving inevitability. For years publishers have complained about late payments from the vendor, and in recent months, sources say that several publishers had reportedly suspended shipments. As for libraries, a growing number of librarians had reported over the summer that their orders were taking many weeks to fill–if they were getting filled at all–prompting speculation about the company's financial health.

Against that backdrop, Jim Milliot at Publishers Weekly exclusively reported on September 11 that vendor Readerlink had entered into an agreement to purchase Baker & Taylor. But on September 26, the day the deal was set to close, Readerlink backed out, sending Baker & Taylor into a death spiral.

Foreclosure?

Meanwhile, in some excellent sleuthing for American Libraries, Breeding pointed to court filings in a separate lawsuit (filed by OCLC over Baker & Taylor's use of Worldcat records for its BTcat offering), which shed light on the dire state of Baker & Taylor.

In effect, after learning of the deal with ReaderLink, OCLC lawyers had asked a federal judge to pause the transaction or at least carve out the disputed BTcat records, given the litigation. In response, Baker & Taylor lawyers noted that the company was in fact in default to its main creditor, CIT Northbridge Credit, and that the ReaderLink deal was a foreclosure sale, and out of the hands of Baker & leadership.

Furthermore, B&T lawyers warned, if the court delayed the ReaderLink deal, Baker & Taylor would not survive.

"If the asset sale to ReaderLink is not consummated, Baker & Taylor will be exposed to immediate liquidation of its assets, potentially in piecemeal fashion, which will put hundreds out of work and destroy the value of the business," Baker & Taylor lawyers argued in a September 24 filing opposing OCLC's motion for a temporary restraining order. Any delay, Baker & Taylor lawyers insisted, "would extinguish Baker & Taylor’s only opportunity to remain a going concern."

A supporting declaration by Baker & Taylor president and owner, Aman Kochar, revealed even more details.

Citing "financial stress on its operations" since 2024, Kochar said Baker & Taylor had tried and failed to find a purchaser or secure additional capital. And in 2025, things had "deteriorated to the point that CIT declared a default and moved to liquidate the assets of Baker & Taylor," with ReaderLink emerging as potential buyer in August.

CIT, Kochar, added, would have received "substantially all the proceeds of the sale."

While Kochar testified that "outside subscriptions for BTCat" were "a small part

of Baker & Taylor’s business," there was, he testified, "no way to carve out BTCat from the sale" without "crippling Baker & Taylor’s operations."

Kochar went on to note that Baker & Taylor had "approximately 4,000 schools, colleges, and public and academic libraries" under contract for books and other physical media. Many of those libraries, he added, had chosen to prepay "with payments totaling over $30 million." Notably, ReaderLink had agreed to honor those contracts, Kochar said, adding that if the ReaderLink deal was disrupted, "libraries would not receive the items they purchase and would lose the substantial investments they made."

Librarians Words & Money spoke to said they were only beginning to sift through the fallout, with many saying they are primarily feeling saddened by the news and what it means for Baker & Taylor employees.

And while many libraries are known to exclusively use Baker & Taylor, most of the librarians Words & Money spoke to said they also had secondary accounts with other providers, such as Ingram, Brodart, and Amazon. Follett Content has also announced plans to service public libraries for children's content.

In an interview this week Ingram officials said their public library business has been growing steadily in recent years as Baker & Taylor’s service declined, opening more than 1,000 new accounts this year alone. And contrary to some misinformation out there, Ingram is taking new customers: come one, come all.

“Absolutely, we're ready. We're taking library specifications. We're setting up accounts quickly. We can be shipping books in a couple of days,” Ingram’s Carolyn Morris told Words & Money.

This is a developing story and we will update as reaction comes in.